- Zero Flux

- Posts

- Factors Weighing Down Multifamily Rents

Factors Weighing Down Multifamily Rents

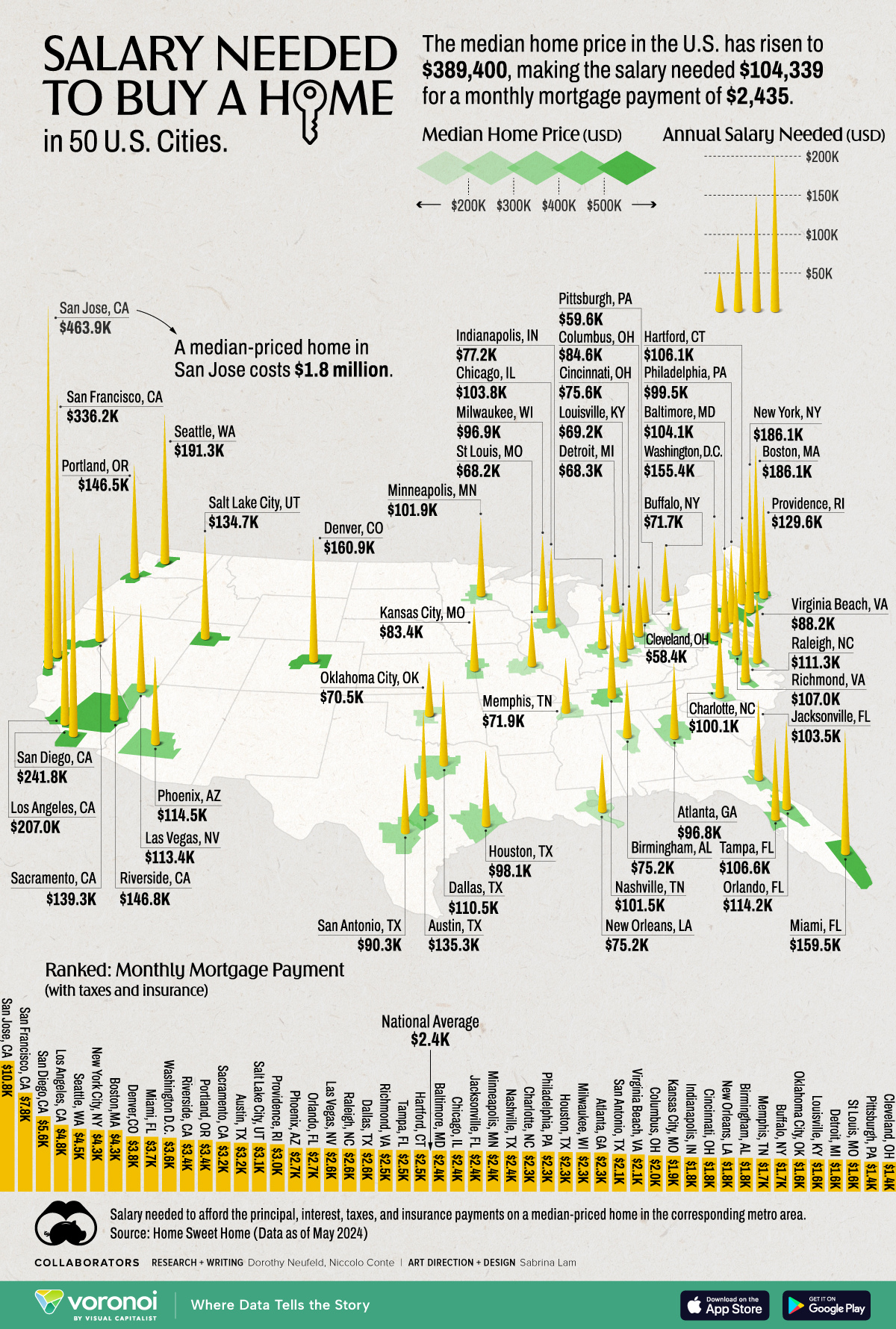

Mapped: The Salary Needed to Buy a Home in 50 U.S. Cities and 9 More Real Estate Insights

In Partnership With

Where Sophisticated Investors Access Private Markets

10 East is a co-investment platform where sophisticated investors access private markets alongside a veteran team with a decade+ track record of strong performance.

Members can participate on a deal-by-deal basis - benefiting from institutional resources, sourcing, vetting, and ongoing monitoring.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.86% | -0.05% | -0.03% | 6.61/8.03 |

15 Yr. Fixed | 6.31% | -0.02% | -0.01% | 5.95/7.35 |

30 Yr. FHA | 6.32% | -0.06% | +0.00% | 6.00/7.44 |

30 Yr. Jumbo | 7.04% | -0.03% | -0.01% | 6.95/8.09 |

7/6 SOFR ARM | 6.53% | -0.02% | -0.05% | 6.11/7.55 |

30 Yr. VA | 6.34% | -0.06% | +0.00% | 6.02/7.46 |

New here? Join the newsletter (it's free).

Macro Trends

Q2 GDP Growth Exceeds Expectations Link

U.S. GDP increased by 2.8% on an annualized basis in Q2 2024, well above market expectations of 2.1%.

Stronger growth was accompanied by easing inflation, with the Core Personal Consumption Expenditures (PCE) Price Index (excluding food and energy prices) closing Q2 at 2.9% annualized vs. 3.7% in Q1.

CBRE expects the U.S. economy to achieve a soft landing this year. However, restrictive monetary policy may heighten the risk to growth.

We expect inflation will continue to ease in H2, helping the 10-year Treasury yield to end the year at 4.0%. We expect to see lower interest rates in H2, which should lead to more real estate investment activity.

Real Estate Trends

The share of ‘stagnant’ listings is rising: Redfin link

In June, 64.7% of homes were on the market for over 30 days, a significant increase from 59.6% the previous year. This is the highest share for June since 2020.

High mortgage rates and unrealistic pricing by sellers are major factors contributing to the rise in stagnant listings. Buyers are hesitant due to elevated prices and await potential Federal Reserve rate cuts.

Texas and Florida cities like Dallas, Tampa, and Fort Lauderdale are seeing the most significant increases in stagnant listings. Dallas, for instance, saw a jump from 52% to 63% year-over-year.

Home Sales Drop for June as Hints of a Buyers' Market Emerge link

Existing home sales fell to an annual rate of 3.89 million in June, marking a 5.4% decrease from the previous month. This drop signals potential shifts towards a buyers' market as inventory increases.

The Midwest experienced the steepest decline with an 8% drop month-over-month, highlighting regional disparities in the housing market. This region's sales were also down 6.1% compared to the same time last year.

The South and West saw decreases of 5.9% and 2.6% respectively, while the Northeast had the smallest decline at 2.1%. This variation suggests differing regional impacts on home sales trends.

Please note: I send an email most weekdays at 6:00 ET, so if you don’t see the email in your inbox in the future, please check your spam.

The Factors Weighing Down Multifamily Rents and Profit Margins link

Multifamily rent growth is expected to remain low, with Moody's estimating a growth range of only 1% for the second quarter of 2024. The persistent gap between asking and effective rents, averaging above $90, reflects high concession levels.

Over-supply is a key factor suppressing rents, with housing completions in June 2024 reaching 1.71 million units. Multifamily units saw the most significant increase, with a 26.2% month-over-month growth, the highest since September 1974.

Rising operating expenses are further squeezing profit margins for landlords, leading to challenges in refinancing. This financial strain impacts the attractiveness of properties to lenders and potential investors.

One Chart

Home Insurance Premiums Are Surging

Image

Pro Member Only Content Below

5 Market Opportunities as Home Sales Eye Turnaround

(This content is restricted to Pro Members only. Upgrade)

2024 Realtor.com Top Markets for Renters

(This content is restricted to Pro Members only. Upgrade)

Here Are the Markets Where New Multifamily Deliveries Should Decrease

(This content is restricted to Pro Members only. Upgrade)

Top 10 U.S. Housing Markets with Highest Priced Homes in Q2 2024

(This content is restricted to Pro Members only. Upgrade)

Top 10 Markets for Apartment Demand in 2nd Quarter

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Mapped: The Salary Needed to Buy a Home in 50 U.S. Cities in 2024

Image

Unreal Real Estate

Looks a little soulless, but I like it

It would mean a lot if you could reply and tell me which story you liked the most. 🙏

That's all, folks.

Cheers,

Vidit

P.S - Read past newsletters here

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply