- Zero Flux

- Posts

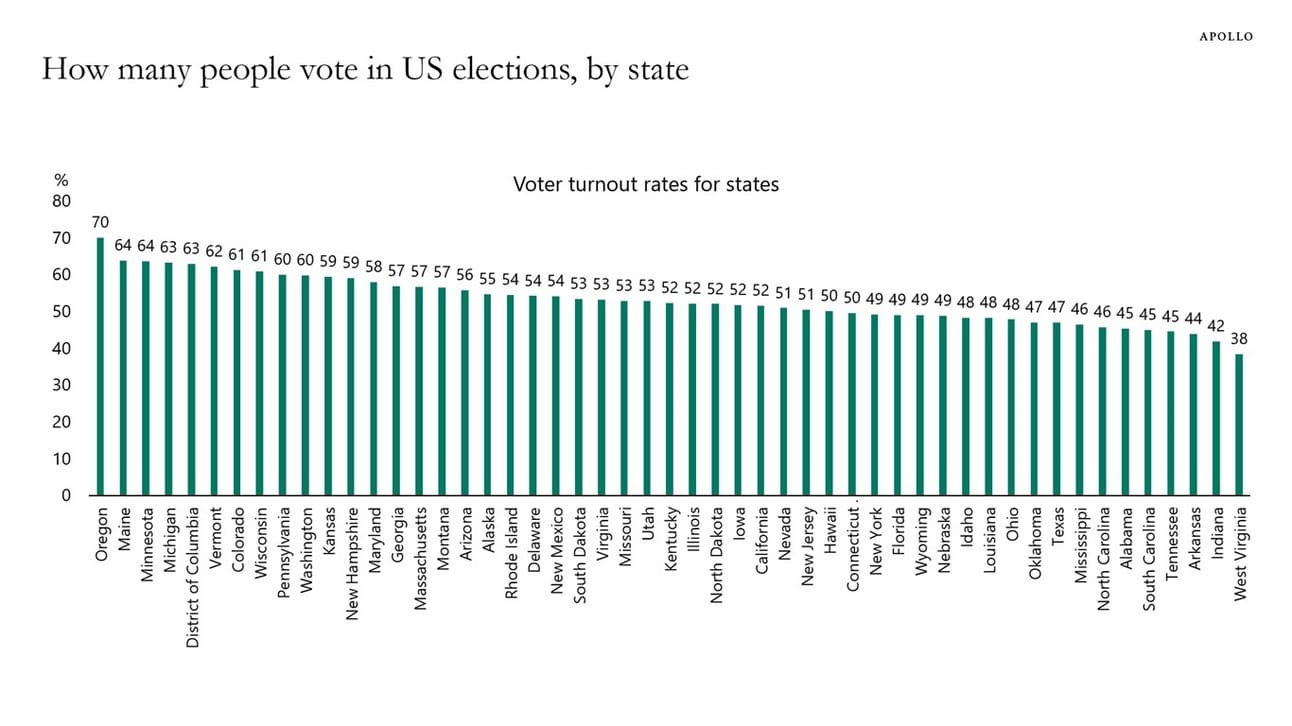

- How many people vote in elections by state?

How many people vote in elections by state?

The Costliest Hurricanes To Hit The U.S and 11 more real estate insights.

Today’s Ad

-

A breakthrough in life-saving injection technology

Led by rocket scientists, MDs, and top engineers from MIT, Harvard, and NASA, Pirouette is developing life-saving auto-injectors for millions of people facing overdoses or severe allergies.

With growing demand—93% of patients and 70% of prescribers eager to make the switch—Pirouette is ready to make a difference in the $750B injectable market.

Backed by YC and leading VCs like Safar Partners and Gaingels, the company has already raised $6M+ in their latest round and there’s still time to join.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.61% | -0.01% | +0.36% | 6.11/8.03 |

15 Yr. Fixed | 6.15% | +0.00% | +0.53% | 5.54/7.35 |

30 Yr. FHA | 6.11% | -0.01% | +0.35% | 5.65/7.44 |

30 Yr. Jumbo | 6.75% | +0.00% | +0.32% | 6.37/8.09 |

7/6 SOFR ARM | 6.55% | -0.02% | +0.40% | 5.95/7.55 |

30 Yr. VA | 6.14% | -0.01% | +0.36% | 5.66/7.46 |

New here? Join the newsletter (it's free).

Macro Trends

How many people vote in elections by state?

Image

Real Estate Trends

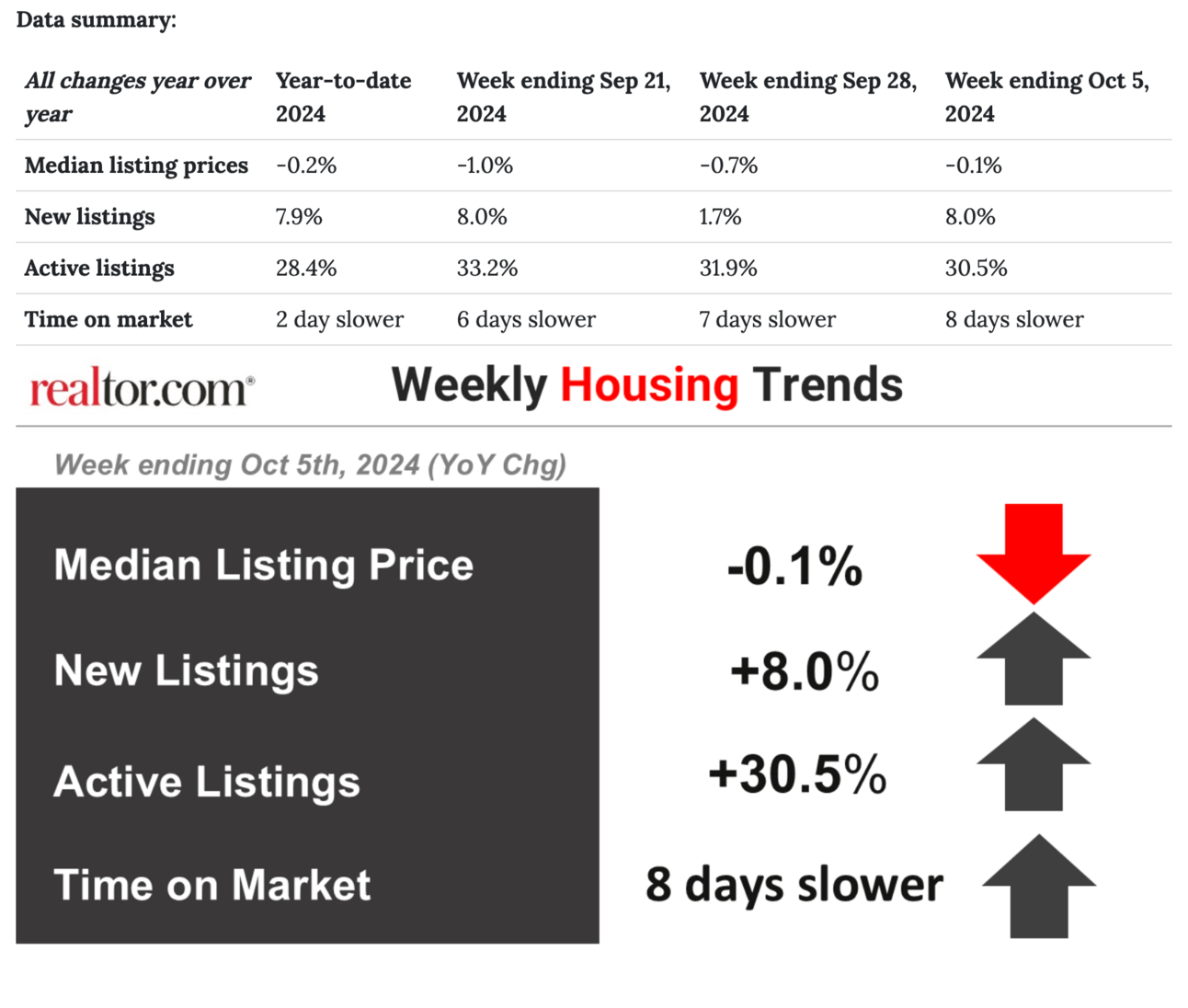

Weekly Housing Trends View—Data for Week Ending Oct. 5, 2024

What this week’s data means

New listing activity picked back up this week and prices stabilized close to year-ago levels. The housing market continues to show signs of improvement, but still-high home prices and elevated mortgage rates mean that further progress may be needed to grease the wheels. As mortgage rates continue to ease through the end of the year and into next, markets with high mortgage-utilization stand to see the most impact. That is to say that homeowners who have a mortgage, versus own their home outright, are more likely to make a sell/no-sell decision based on mortgage rate progress. Markets with a higher share of mortgage-holding buyers therefore may see more listing activity as rates fall.

Large deals fuel big surge in Silicon Valley office leasing link

Silicon Valley's office leasing surged to 1.7 million square feet in Q3 2024, up from just 700K square feet in Q2. This marked the highest leasing level since Q3 2022, driven by deals with Apple, ByteDance, and Yahoo.

The office availability rate in Silicon Valley dropped to 27.6%, a decline of 110 basis points from the previous quarter, though sublease space remains high at 7.7 million square feet. Downtown San Jose's availability ticked down to 35.2%.

SC Properties and South Bay Development snapped up office campuses at steep discounts, with purchases in San Mateo and Santa Clara made for about half or a third of their original prices. Investors are betting on a recovery fueled by a push for more in-person office work.

Operators increase concessions in Q2 amid rising competition link

Over 20% of professionally managed apartments offered concessions in Q2 2024, marking a significant year-over-year rise. Despite this, concession levels are still well below the peak seen in 2009 when nearly two-thirds of units provided them.

Occupancy hit 94.2% in Q2 2024, a 50-basis-point drop compared to the previous year. The report highlights that higher concessions typically align with lower occupancy rates, as seen during the last two decades.

Berkadia forecasts a 20-basis-point rise in occupancy by the end of 2024, with further growth to 94.8% by late 2025. The number of units offering concessions is predicted to drop 120 basis points by the end of this year, indicating improving conditions for operators.

I post the most popular insights from the day on Instagram. If you like colorful visuals, please follow along here ↓

Instagram

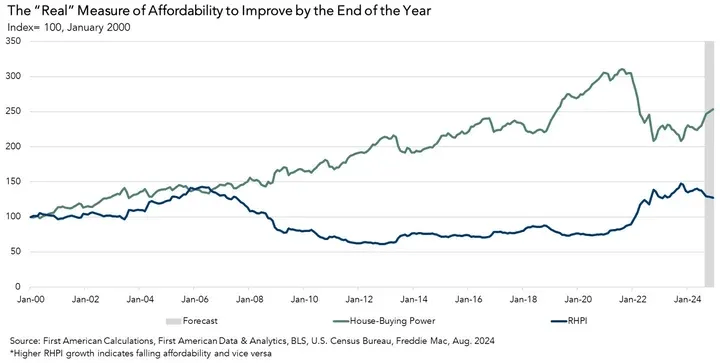

National housing affordability improves annually for first time in post-pandemic era link

National affordability improved 4.4% annually in August, driven by a 3.1% increase in household income and a 0.57% drop in 30-year mortgage rates. This marks the first positive annual change in affordability since 2021.

If mortgage rates fall to 6% by the end of 2024 and income growth follows historical averages, affordability could rise by 7% by year-end. Projections for 2025 suggest further rate reductions, improving prospects for potential buyers.

Real house prices dropped 4.4% year-over-year in August, with affordability also improving by 9.3% due to higher income and lower mortgage rates. However, house prices remain 62.4% above their 2006 peak, while adjusted prices are still below.

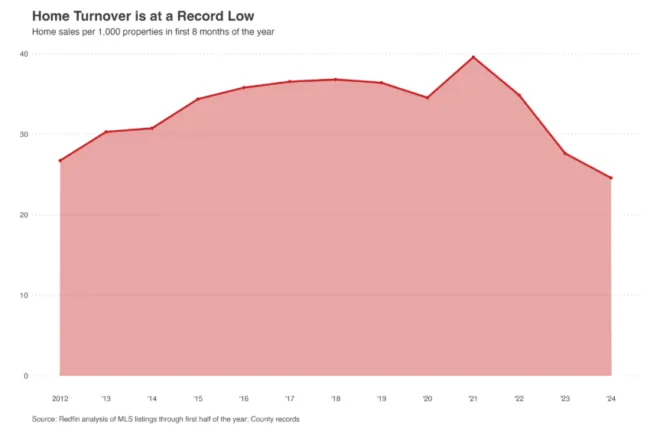

Just 2.5% of U.S. homes changed hands this year, the lowest rate in decades link

Home turnover in the U.S. hit a historic low, with only 25 out of every 1,000 homes changing hands in the first eight months of 2024. This is a 31% drop from 2019 and a 37.5% decline from the 2021 pandemic peak.

Mortgage rates exceeding 7% have trapped many homeowners with sub-5% rates, causing a “lock-in effect” and discouraging new listings. This led to a 30% reduction in the number of homes listed compared to pre-pandemic levels.

Cities like Phoenix and Newark have the highest turnover rates, with over 35 of every 1,000 homes sold, while Los Angeles and Boston saw the lowest, with only 15 sales per 1,000 homes. California metros dominate the bottom of the list due to longstanding property tax laws.

Something I found Interesting

Hedge fund Deer Park eyes distressed property debt in 2009 rerun link

Deer Park Road Management aims to raise $500 million for its new commercial mortgage fund, which targets debt tied to office properties at steep discounts. The firm expects to offer an 8% return on investments in this distressed market.

Commercial real estate, particularly office buildings, has seen values drop by 60-80% amid high interest rates and defaults. Many lenders are selling these assets quickly, creating buying opportunities for Deer Park.

The firm is looking to attract investors from Europe, the Middle East, and multi strategy hedge funds. Deer Park is confident about long-term returns as liquidity issues emerge in commercial real estate sectors.

Pro Member Only Content Below

The price tag that comes with living in America’s top college towns

(This content is restricted to Pro Members only. Upgrade)

Here are the country’s hottest rental markets right now

(This content is restricted to Pro Members only. Upgrade)

Demographic trends point to continued housing demand.

(This content is restricted to Pro Members only. Upgrade)

See where the housing market could change the most as mortgage rates drop

(This content is restricted to Pro Members only. Upgrade)

Industrial tenant trends

(This content is restricted to Pro Members only. Upgrade)

Trends in Pending Sales in Metro Areas

(This content is restricted to Pro Members only. Upgrade)

Off Topic

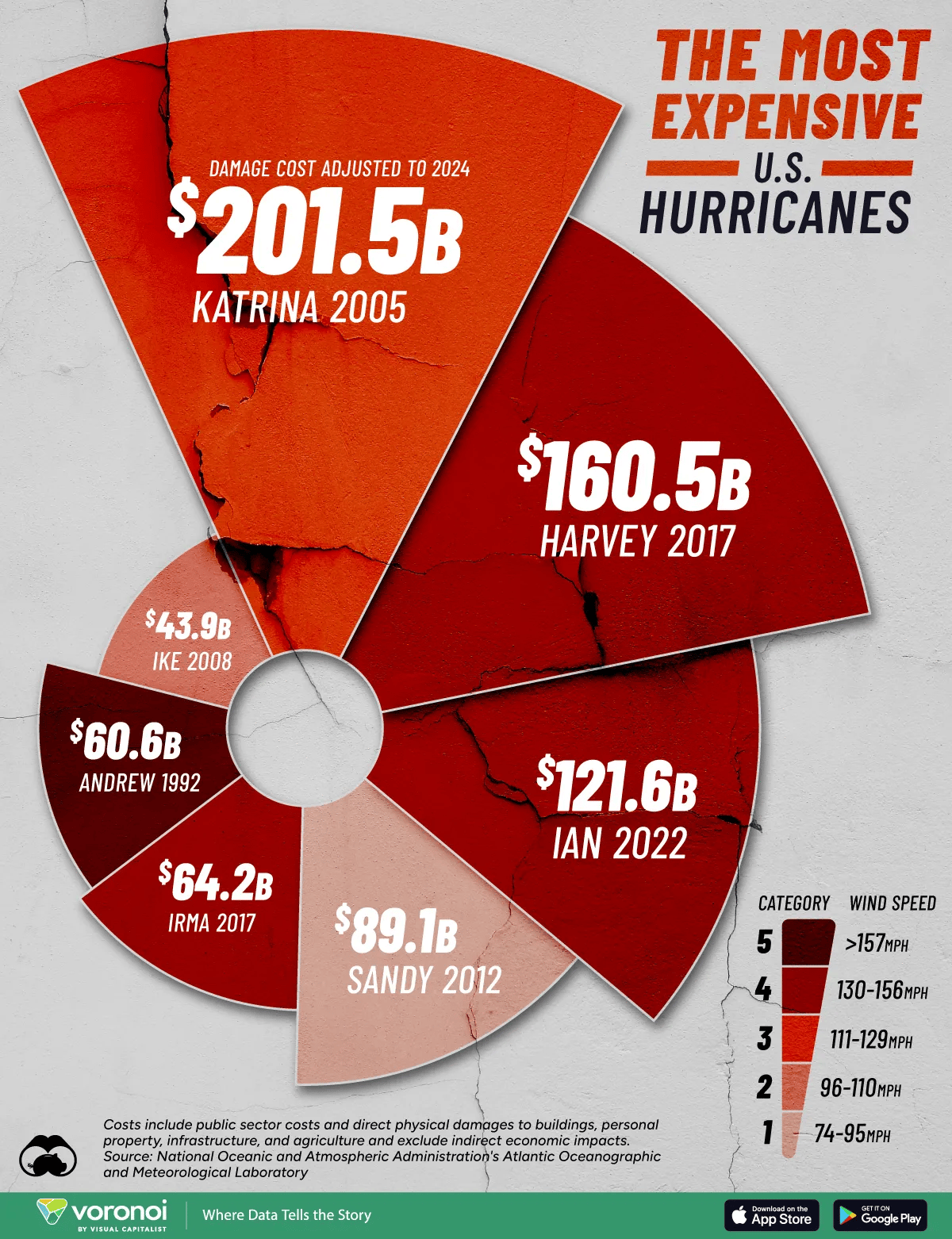

The Costliest Hurricanes To Hit The U.S.

Image

Unreal Real Estate

You never know what the inside looks like.

That's all folks. Let me know what you think of the email. Quite a lot went into it. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply