- Zero Flux

- Posts

- Markets with the Most Fortune 500 Headquarters + New Section

Markets with the Most Fortune 500 Headquarters + New Section

Charted:Which Countries Have Universal Health Coverage? and 5 more RE insights

Hey, If you have not received an email in a while, as a reminder you signed up on Zero Flux - A daily newsletter with 5-10 actionable real estate trends.

Unsubscribe below if you would like to stop receiving future emails

A Quote

"You don't have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long, time."

― Charlie Munger

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.99% | +0.02% | -0.16% | 6.61% / 8.03% |

15 Yr. Fixed | 6.40% | +0.02% | -0.20% | 5.95% / 7.35% |

30 Yr. FHA | 6.44% | +0.01% | -0.20% | 6.00% / 7.44% |

30 Yr. Jumbo | 7.23% | +0.01% | -0.14% | 6.67% / 8.09% |

7/6 SOFR ARM | 7.01% | +0.00% | -0.14% | 6.11% / 7.55% |

Real Estate Trends

State of the Housing Market: John Burns Consulting link

The new home market is in a "Goldilocks" period, with demand outstripping available inventory and a stable economy. High sales and healthy gross margins are reported despite elevated mortgage rates.

Big homebuilders are growing larger and more efficient, increasing market share significantly. Public builders and those with public debt delivered 55% of all new homes in the US.

Builders are addressing affordability by offering smaller homes, rate buydowns, and simplified designs. The new home price premium over resale homes fell to 7%, below the historical average of 16%.

Concerns include rising unsold speculative inventory and increasing resale inventory in markets like Texas and Florida. There are also worries about the sustainability of demand with high mortgage rates.

Enjoy the newsletter? 🙏 Please forward to a friend. It only takes 10 seconds. Writing this one took 3 hours. A referral also earns you a 3-month free trial of the pro plan. Share the link at the end of the email.

Minimal Rent Growth Expected for U.S. Multifamily Market in 2024 link

Advertised multifamily rents are up 1.1% year-to-date, with year-over-year increases holding steady at around 0.6% each month. Analysts forecast a 1.7% rent growth for the year, significantly lower than the 24% gains seen in 2021 and 2022.

Regional performance varies, with the Midwest and Northeast seeing steady rent growth due to strong labor markets and economic growth. In contrast, the Sun Belt faces rent pressures from an influx of new supply.

Nationwide, up to 553,000 of 1.2 million units under construction are expected to come online by the end of 2024. Recent years have seen increased supply driven by high demand, rapid rent growth, and development capital influx, with 1.3 million units added between 2021 and 2023 compared to 858,000 units in the early 2010s.

New here? Join the newsletter (it's free).

Something I found Interesting

Some Luxury Retailers Opting to Buy Rather Than Lease Iconic Buildings link

Prada spent $425 million to purchase 724 Fifth Ave. in Manhattan, where it had been leasing space since 1997. This move highlights the shift from leasing to ownership among luxury retailers.

Kering made significant investments, including $963 million for properties at 715-717 Fifth Ave. in Manhattan and $1.4 billion for an 18th-century building in Milan's Via Montenapoleone. These acquisitions enhance brand recognition and offer more control over the retail experience.

The trend is partly driven by economic factors, as a CBRE analysis indicates foot traffic in top retail districts will return to pre-pandemic levels by Q4 2023. Building ownership provides insulation from rising rents and offers opportunities to develop new customer channels.

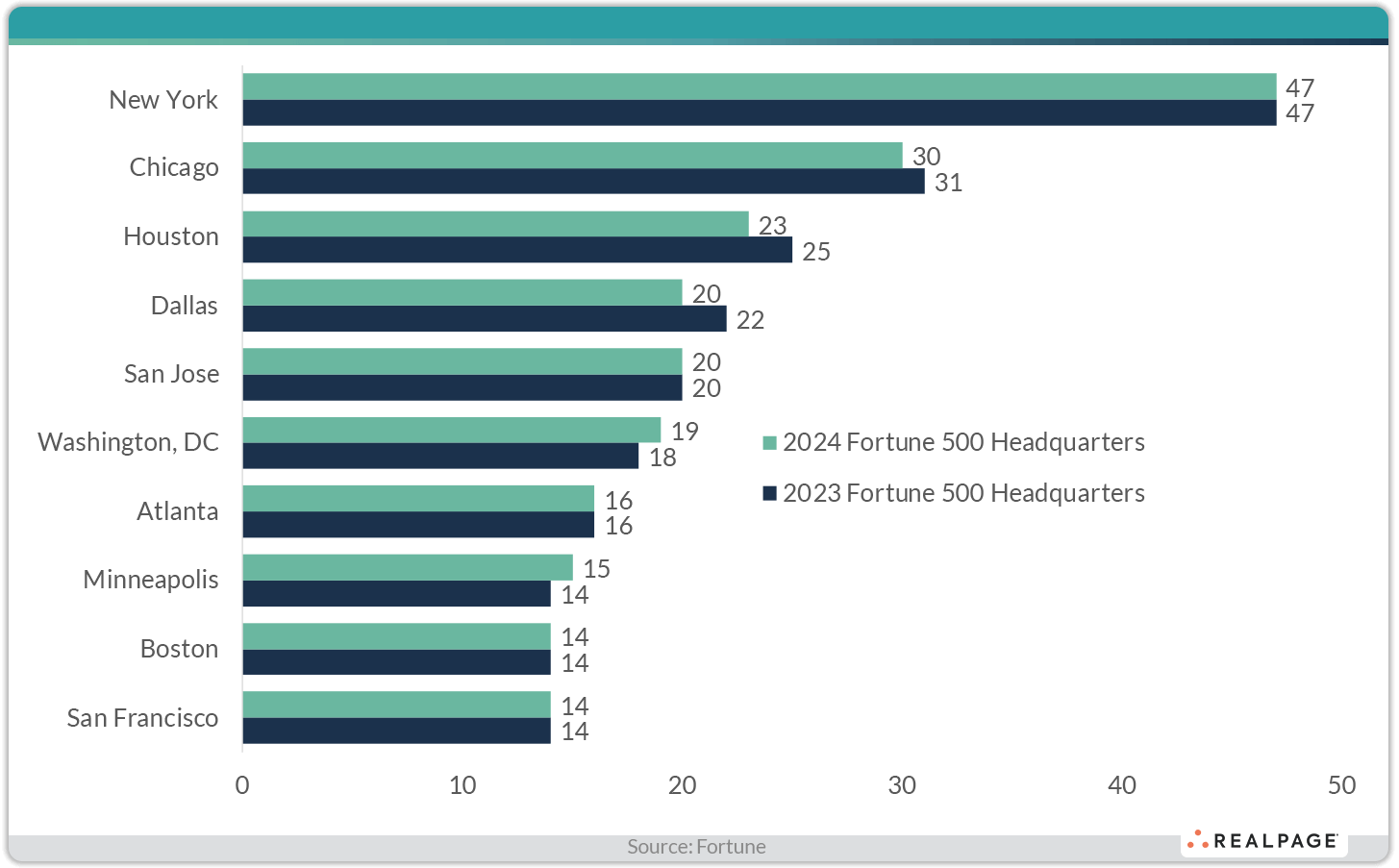

One Chart

Markets with the Most Fortune 500 Headquarters in 2024

Image

Pro Member Only Content Below

Cities With the Most Homes Priced Below $200,000

(This content is restricted to Pro Members only. Upgrade)

This is Where Multifamily Distress Can Be Found

(This content is restricted to Pro Members only. Upgrade)

States That Face the Highest Risk of Housing Market Slowdowns

(This content is restricted to Pro Members only. Upgrade)

Top 10 U.S. Housing Markets Least At-Risk of Declines in Q1 2024

(This content is restricted to Pro Members only. Upgrade)

This asset has more than 76,000 Units Under Construction in the South

(This content is restricted to Pro Members only. Upgrade)

Latest Proptech Funding Rounds

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Which Countries Have Universal Health Coverage?

Image

An Interesting Property

$1.6M ‘Concrete Home’ Offering A Cool Oasis link

(Do you like this new section? Please reply and let me know 🙏)

Image

It would mean a lot if you could reply and tell me which story you liked the most 🙏. It helps me pick the best trends, but your reply also helps with deliverability + ensures the email lands in your inbox. 🙂

That's all, folks.

Cheers,

Vidit

P.S - Read past newsletters here

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

Want to sponsor the newsletter? Details here

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Reply