- Zero Flux

- Posts

- Nation’s Only High Supply Apartment Market to Grow Rents

Nation’s Only High Supply Apartment Market to Grow Rents

Plus, This Week's Housing Trends Summary and 5 more Real Estate Insights

Hey

If you have not received an email in a while, as a reminder you signed up on Zero Flux - A daily newsletter with 5-10 actionable real estate trends.

If you would like to unsubscribe, here is a quick link

Today’s Sponsor

Make Your Money a Multitasker.

With Betterment's expert-built ETF portfolios, you’re automatically diversified across thousands of stocks and bonds at once. These expert-built portfolios are designed to help reduce risk, regardless of what’s happening in the market.

A Quote

What matters in life is not what happens to you but what you remember and how you remember it.

~ Gabriel Garcia Marquez

Today’s Rates

6.99% | 6.44% | 6.72% | 6.44% |

Real Estate Trends

Weekly Housing Trends Data - Week Ending March 30, 2024 link

Image

Median listing prices saw a slight decrease of 0.6% compared to last year, marking a rare occasion of year-over-year decline. This trend suggests some easing in the housing market, potentially offering a slight reprieve for homebuyers.

New listings dropped by 7.8% this week due to the Easter holiday, ending a 22-week streak of growth. This temporary dip is expected to correct itself, indicating the market's resilience and the transient impact of holidays on housing trends.

Active inventory surged by 25% over last year, providing more options for today’s home shoppers. Despite this increase, the market remains tight with inventory levels still 37.9% lower than the pre-2023 average, highlighting the ongoing challenge of limited housing supply.

Affordable inventory experienced a significant increase, with homes priced between $200,000 and $350,000 rising by 30.5% compared to last year. This growth in lower-priced homes may offer more opportunities for first-time buyers and those seeking more budget-friendly options.

Homes spent the same amount of time on the market as last year, indicating a balanced pace of sales despite the increase in inventory. This stability suggests that while buyers have more options, the demand remains strong, keeping the market competitive.

Enjoy the newsletter? 🙏 Please forward to a friend. It only takes 10 seconds. Writing this one took 3 hours. A referral also earns you a 3-month free trial of the pro plan 🙂

Apartment Expenses Grow as Insurance Premiums Spike link

Property insurance, though only 7% of total expenses, significantly impacts apartment operations as its cost share increases. The surge in insurance costs is particularly notable in the Southeast and other regions prone to weather-related damages, stressing the budget of apartment owners.

Obtaining property insurance in areas frequently hit by hurricanes, floods, and fires is increasingly challenging. This difficulty not only elevates operational costs for property owners but also complicates financial planning and risk management in vulnerable regions.

The Nation’s Only High Supply Apartment Market to Grow Rents link

Image

Savannah, GA stands out as the sole U.S. apartment market to achieve rent growth alongside a more than 4% increase in inventory. Over the past year, while most U.S. markets with significant new supply saw rent reductions, Savannah saw its inventory grow by 6.5% with the addition of 2,089 units, yet still managed a 1.5% increase in rents.

This performance places Savannah in a unique position. Among the 14 U.S. markets experiencing inventory growth above 6%, Savannah was the only one to report positive rent growth. In contrast, other markets with over 6% growth in inventory reduced rents by at least 1.5% over the same period.

New here? Join the newsletter (it's free).

It would mean a lot if you could reply (even with a ‘Hi’ or any feedback) to this email - it helps with deliverability and ensures the email lands in your inbox. 🙂

Off Topic

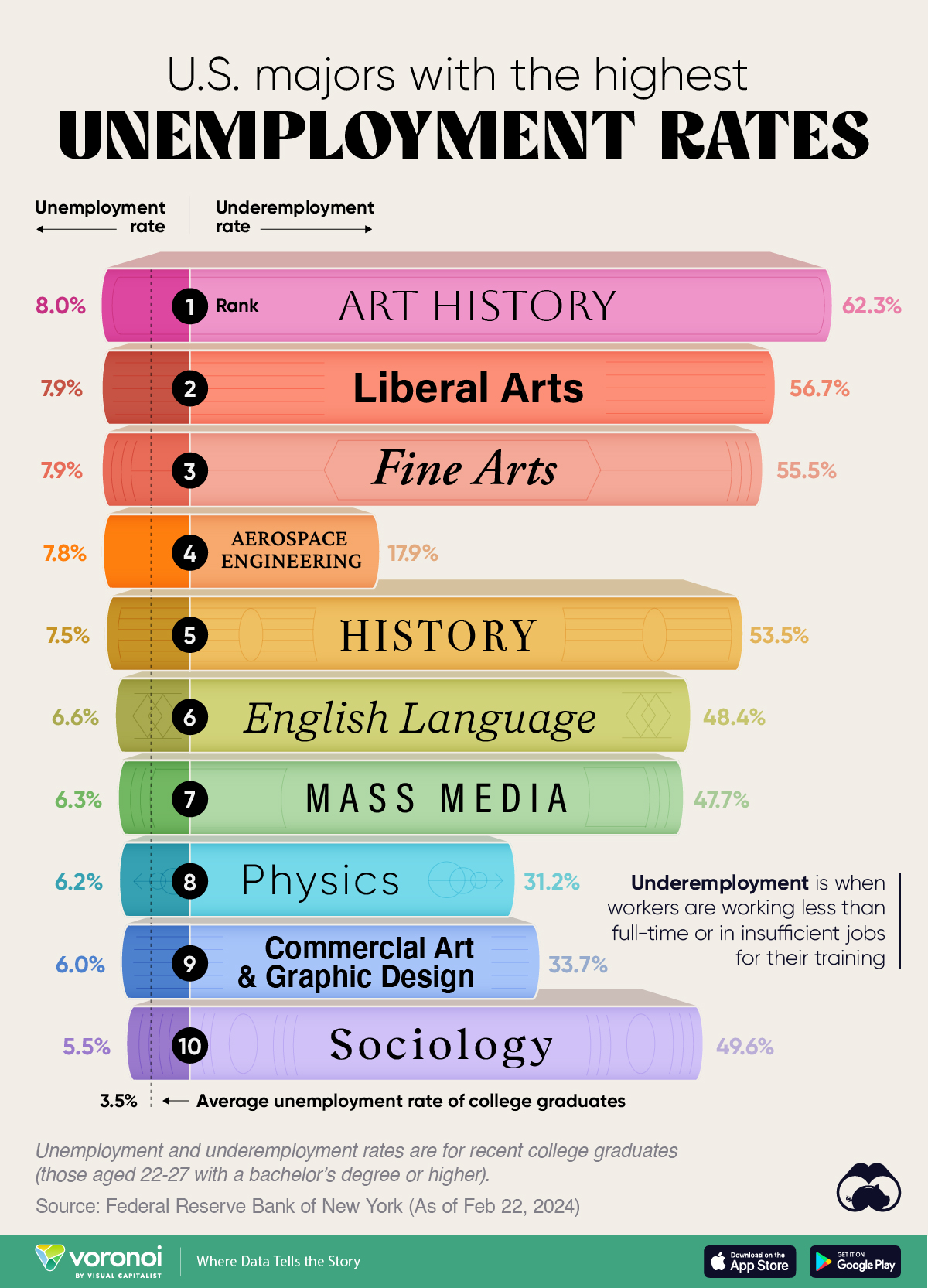

Which College Major is Worst For Finding a Job

Image

Charted: Donald Trump’s Net Worth (2014-2024)

Image

Please note: I send an email most weekdays at 6:00 ET, so if you don’t see the email in your inbox in the future, please check your spam.

Location Specific

Manhattan Office Leasing Drops 23% link

The first quarter of 2024 saw a significant 23% decrease in office leasing activity in Manhattan, contrasting sharply with the previous quarter's surge. This downturn was notable as leasing volume fell to 6.8 million square feet from 8.9 million square feet.

Compared to the same period last year, the current quarter's leasing figures are also down by 6.6%. This decline indicates a cooling off from the end-of-2023 leasing frenzy driven by mega-leases, suggesting a shift in market dynamics or investor sentiments.

Pro Member Only Content Below

Zillow’s 2024 Best Markets for First-Time Home Buyers

(This content is restricted to Pro Members only. Upgrade)

Latest Proptech Funding Rounds

(This content is restricted to Pro Members only. Upgrade)

That's all, folks.

Cheers,

Vidit

P.S - Read past newsletters here

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

Want to sponsor the newsletter? Details here

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Reply